mortgage refinance transfer taxes

Florida mortgage transfer tax calculator florida state mortgage tax florida mortgage refinance tax florida mortgage refinance cost refinance mortgage transfer tax florida florida transfer. Ad Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

Mortgage Refinancing Loans Canada

The tax must be paid by the person who executes the deed instrument or other writing or the person for whose use or benefit the deed instrument or other writing is.

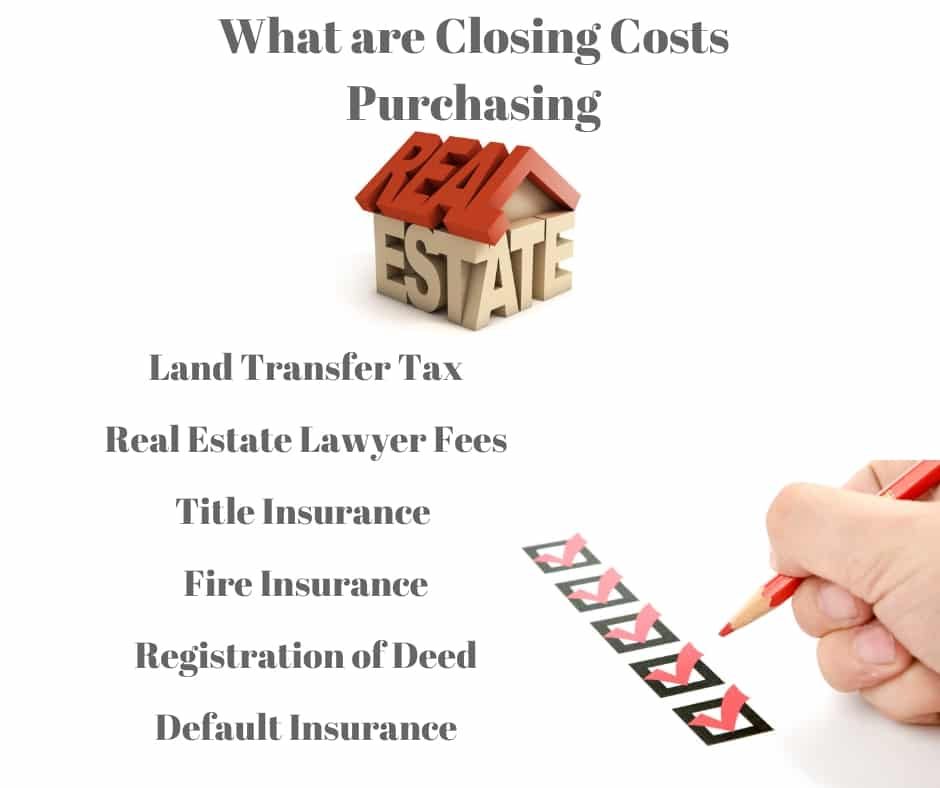

. The tax is usually paid as part of closing costs at the sale or transfer of property. A property selling for. If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. Trusted by 45 million users. The transfer tax is ad valorum Latin for to the value and comprises a percentage of the deeds total worth.

That means a home that sells for 1 million is has a transfer tax of 14. Note that transfer tax rates are often described in terms of the amount of tax charged per 500. State Transfer Tax is 05 of transaction amount for all counties.

The real estate transfer tax is based upon the propertys sale price at the rate of 1 for the first 1000 or fractional part of 1000 and at the rate of 10 cents for each additional 100 or fractional part of 100. If the property is a work. In contrast to a property transfer Maryland State law and the County do not require that property taxes must be paid if you refinance your mortgage.

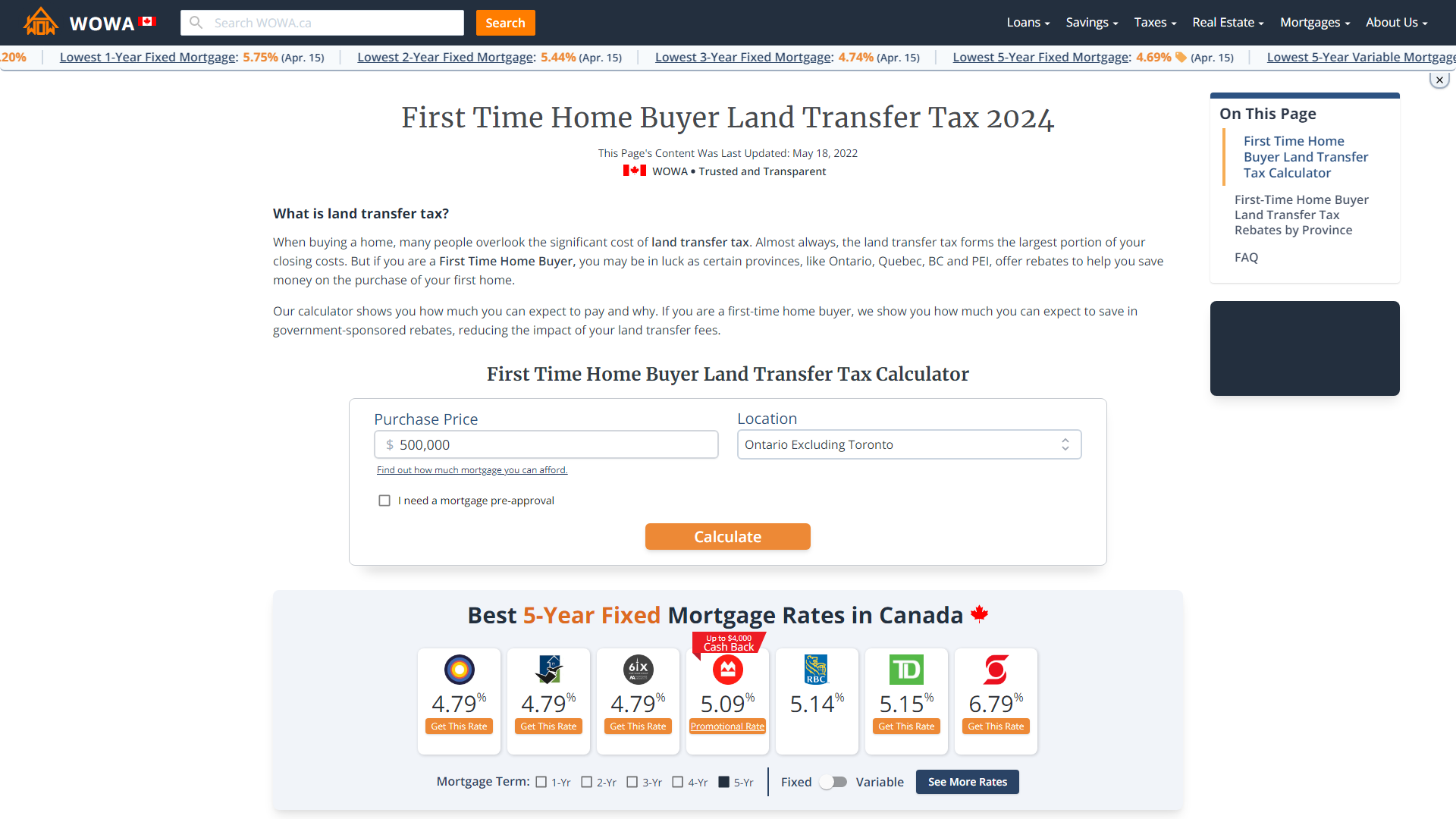

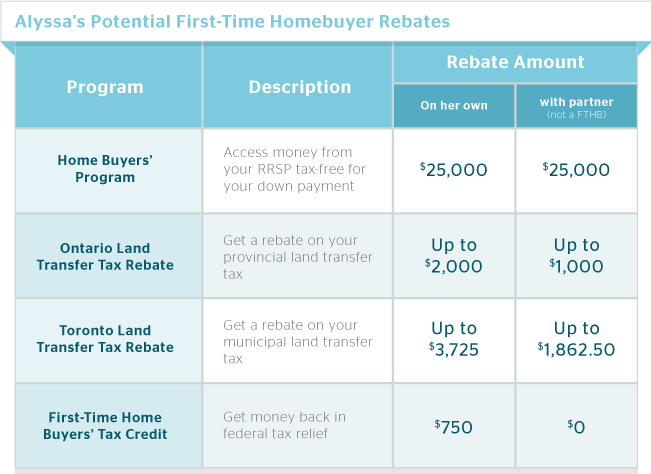

As a first-time home buyer you would only have to pay a 75 transfer tax for a home price of up to 400000. The average transfer tax is 1 to 3 per 1000 of the sales price but some areas add additional transfer taxes on top of the base costs. Refinancing your mortgage can help you get a lower interest rate and a cheaper monthly payment.

Transfer taxes are not tax. Compare Top Mortgage Refinance Lenders 2022. There are typically four life and economic events there are more.

Ad Refinancing Doesnt Have To Be Hard Its Easy With Us. Percentage rates also fluctuate based on the value bracket of a home. No transfer taxes are not tax deductible since they are a charge to legally transfer a real estate title.

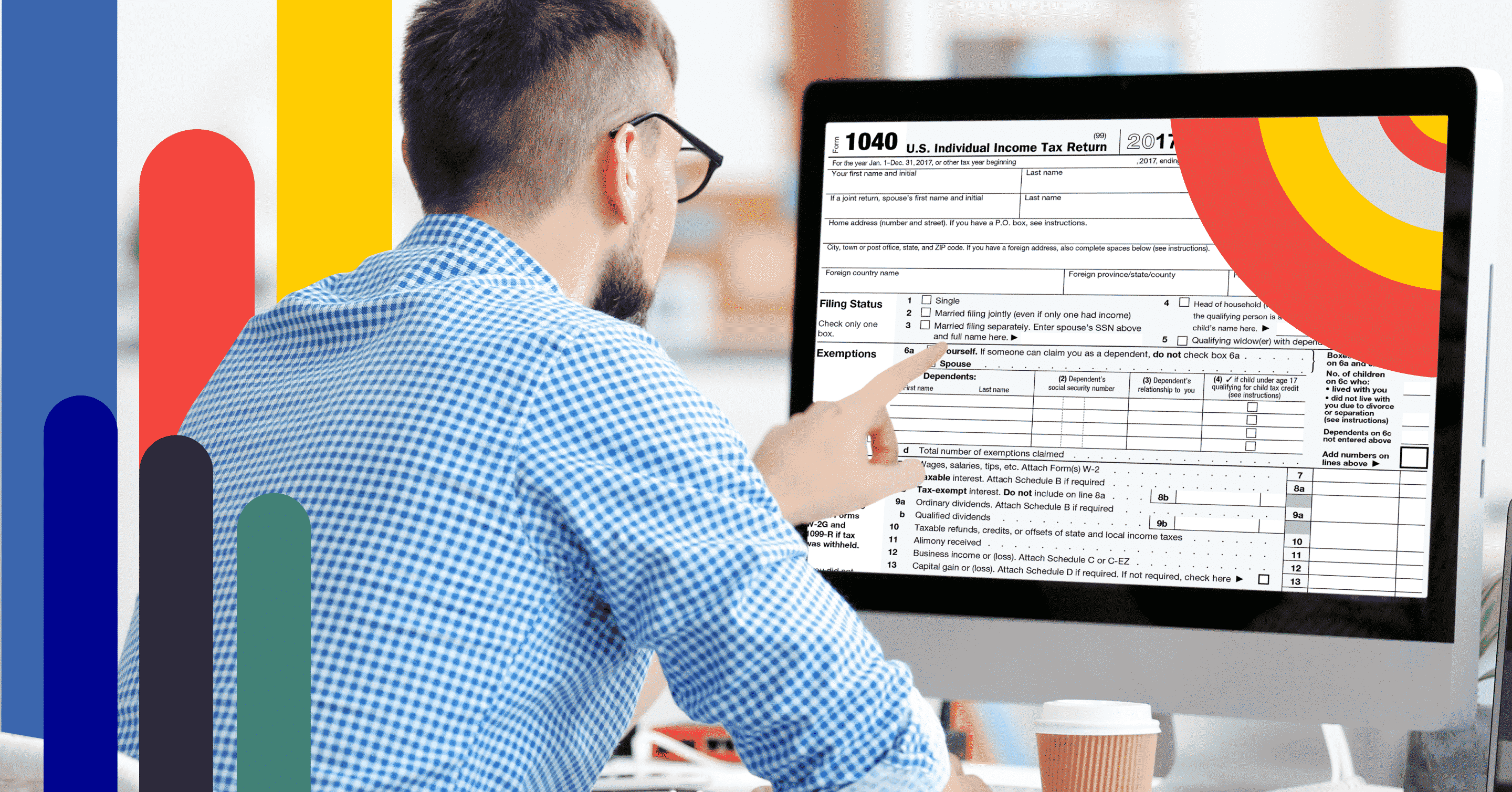

In some states the transfer tax is known by other names. Refinancing to a lower mortgage rate means youll be paying less interest which means youll have less mortgage interest to deduct when tax time comes around. State Recordation or Stamp Tax see chart below County Transfer Tax see chart below Borrower pays on the difference of.

Your transfer tax is equal to a percentage of the sale price or appraised value of the real estate that you buy or sell. Ad Compare Refinance Lenders Based on Whats Important to You. The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed.

Ad Thinking of Refinancing a home. 52 rows Total transfer tax. Residential Type 1 and.

Glossary 416 400-5500 APPLY ONLINE. 2400 12 680 034 None. How Much Can You Save.

The difference can be substantial. On any amount above 400000 you would have to pay the full 2. The tax rate and amount of tax due depends on the type of sale or transfer of property.

Unlike real estate transfer taxes mortgage transfer taxes are calculated as a percentage of the mortgage instead of a percentage of the homeâs sale price. Some more popular cities tend to charge additional. Apply Online Get Your Rate In 3 Minutes.

Deed transfer tax rates vary by state. Dont Sign Before Comparing Top Mortgage Refinance Lenders. - Recordation Tax also charged if owner occupied.

If youve been paying 5 percent on a 30-year mortgage loan and refinance to a 15-year fixed-rate mortgage at 3 percent youve suddenly reduced your interest costs by 40 percent. Last Call To Take Advantage Of This Septembers Super-Low Refi Rates. For instance in New York State the deed transfer tax equals two dollars for every 500.

Transfer Tax 19 14 County 5 State - Recordation Tax also charged on refinances and 2nd trusts if property is not owner occupied. Like many things there is one exception to this rule. New York 2000.

For example Colorado has a transfer tax rate of 001 while people. Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing. Transfer tax differs across the US.

REFINANCE TRANSFER Need a loan with flexible lending criteria and negotiable terms. It might also be added that apparently there is a. Land Transfer Tax Calculator.

Mortgage Refinance Calculator In Canada Nesto Ca

Is Mortgage Interest Tax Deductible In Canada Nesto Ca

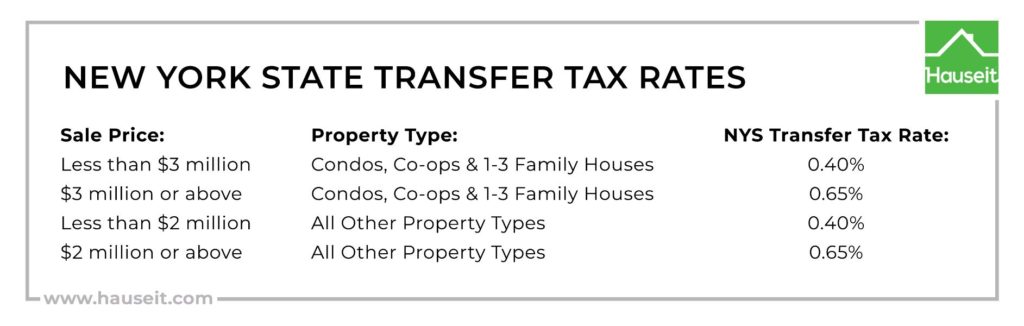

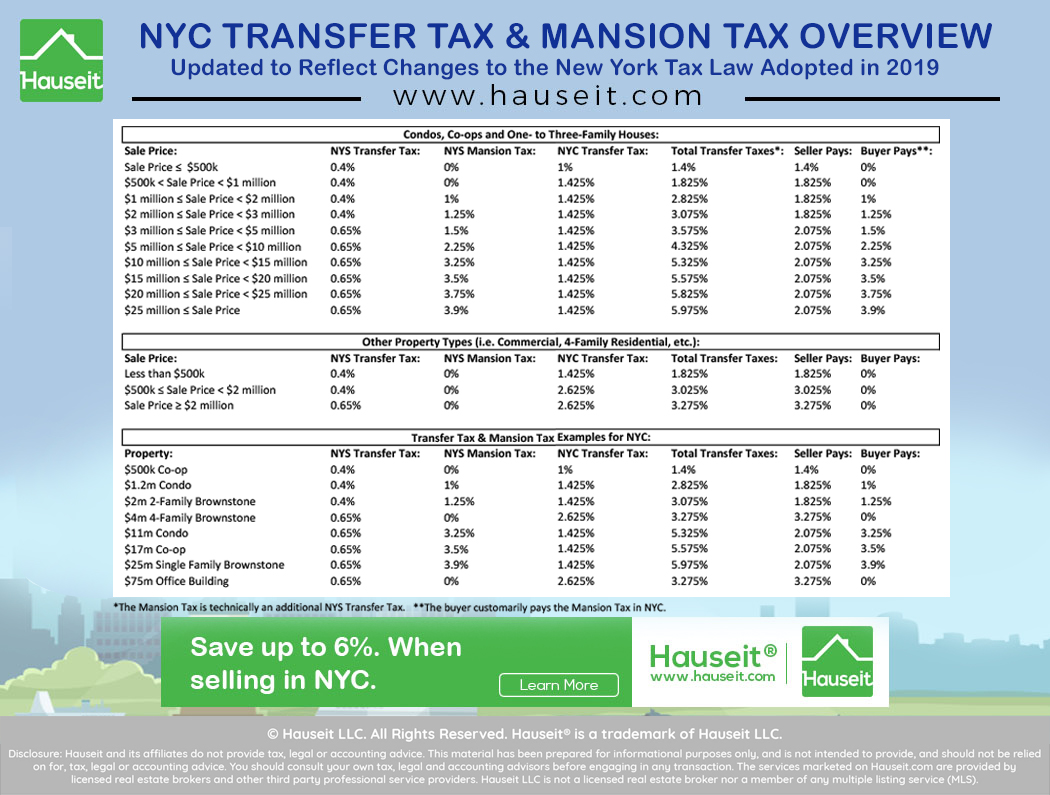

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

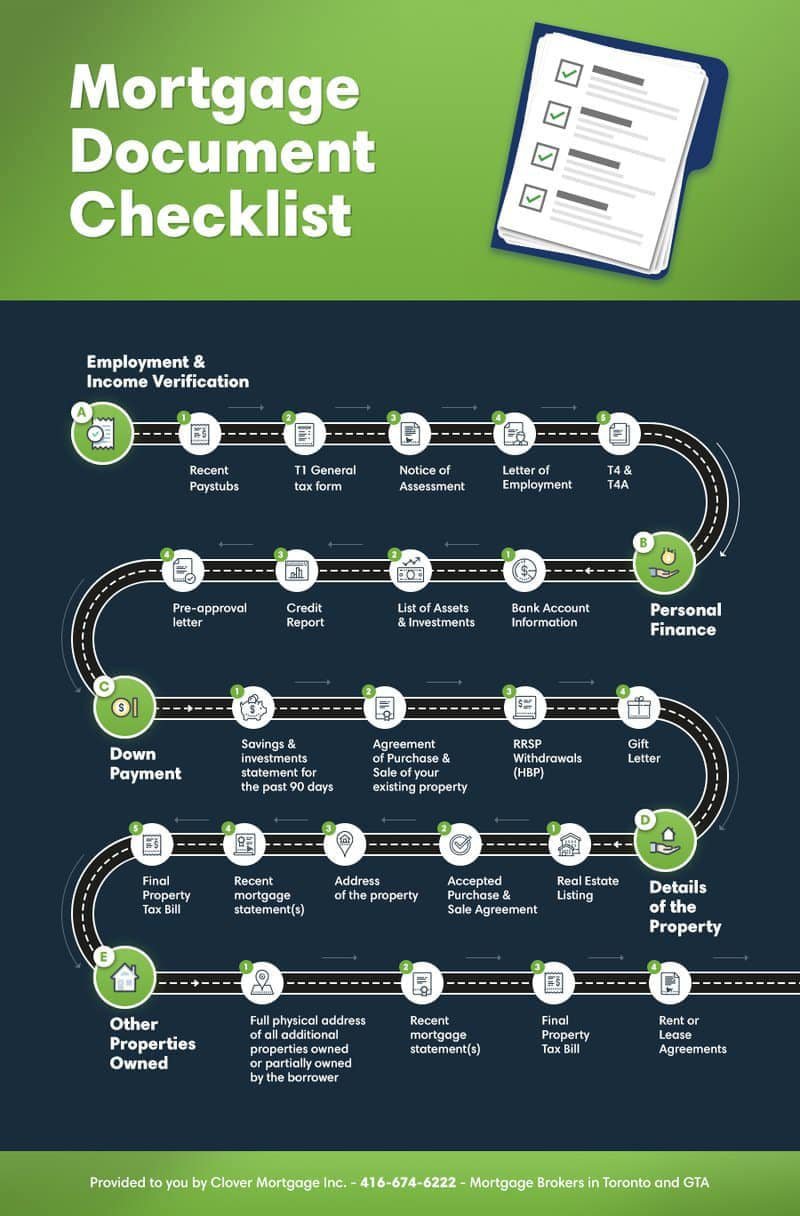

Mortgage Document Checklist What You Need Before Applying For A Mortgage

What Are Real Estate Transfer Taxes Forbes Advisor

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Closing Costs Ontario You Must Know Before Buying Or Selling Property

Mortgage Refinance Tax Deductions Turbotax Tax Tips Videos

Toronto Land Transfer Tax 2022 Calculator Ratehub Ca

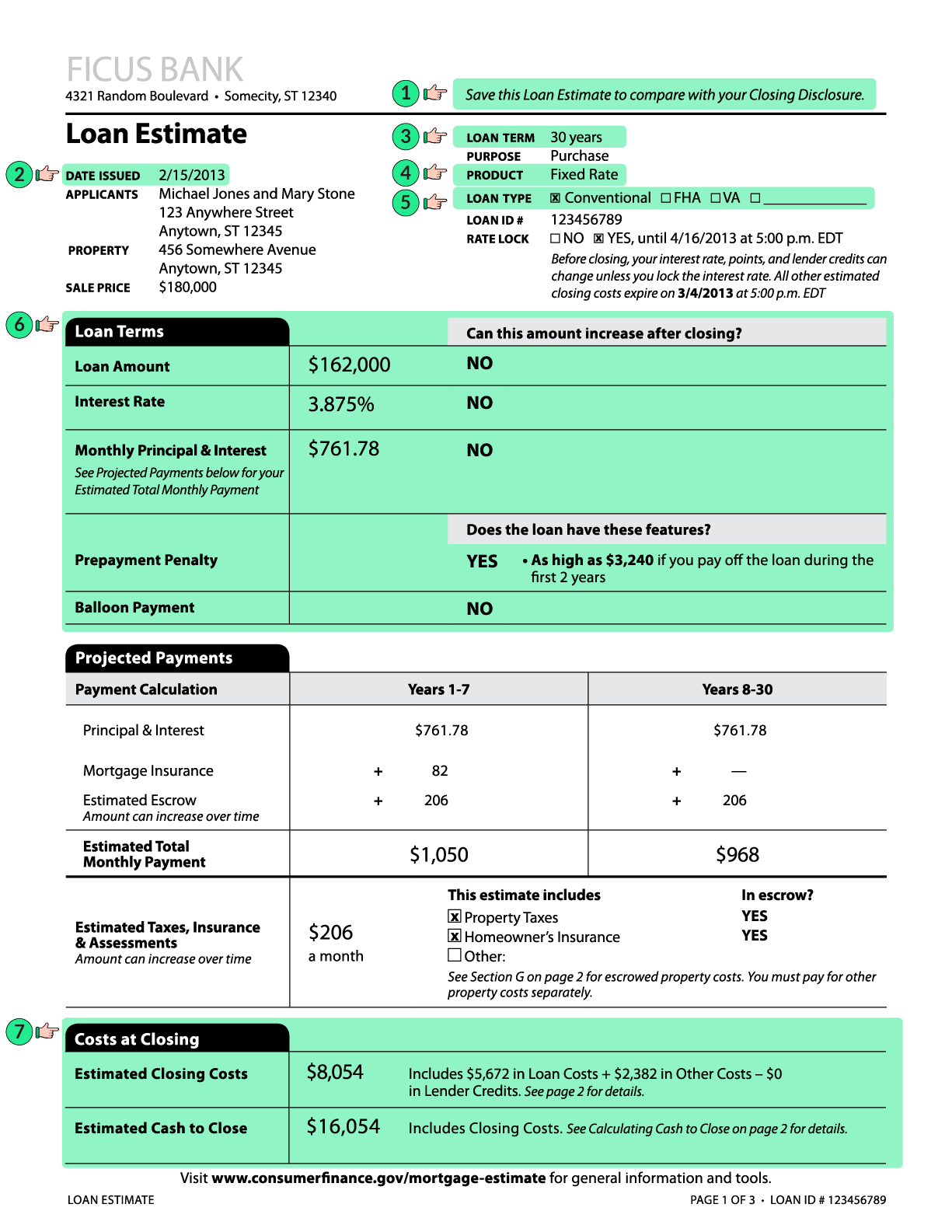

What Is A Loan Estimate How To Read And What To Look For

What If My Co Purchaser And I Don T Both Qualify As First Time Homebuyers Ratehub Ca